Buying a rental residential property can easily be a wise expenditure strategy for producing passive earnings and spending off your mortgage loan. By leveraging the rental earnings, you can dramatically minimize the financial trouble of your home loan remittances. In this blog post, we will talk about how to effectively utilize rental residential properties to pay off your home loan and produce a sustainable resource of easy profit.

1. Select the Right Property

The initial step in taking advantage of rental properties to pay off your mortgage is selecting the right residential property. Look for residential properties in good sites with higher requirement for services. Consider variables such as closeness to colleges, transit, and conveniences. In 按揭出租注意事項 , make sure that the property is in excellent health condition and needs minimal repair work or improvements.

2. Calculate Rental Income Potential

Prior to wrapping up the purchase, it is vital to work out the prospective rental profit of the home efficiently. Conduct in depth market study and study similar residential properties in the location to determine an appropriate rental price. Take in to profile expenses such as residential or commercial property tax obligations, servicing costs, insurance costs, and administration expenses when determining your internet rental profit.

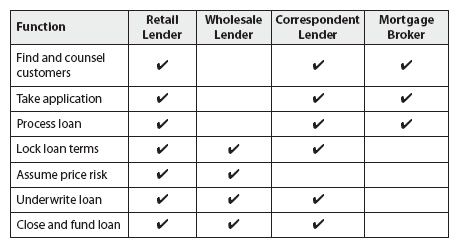

3. Get Money

To get a rental home, you may need to have money management options such as mortgage loans or fundings particularly created for assets residential or commercial properties. Purchase around for competitive enthusiasm prices and terms that align with your long-term targets of paying off your home mortgage using rental profit.

4. Reduce Vacancy Periods

Vacancies may disrupt money circulation and impair improvement in the direction of paying out off your mortgage rapidly. Decrease vacancy periods by advertising early when residents are prepping to move out, carrying out comprehensive tenant assessments, keeping good relationships along with trusted lessees via outstanding communication and cause actions to their needs.

5. Established Reasonable Rent Increases

Frequently reflect on rental fee prices located on market conditions but be cautious not to enhance rental payments also dramatically as this could lead to lessee turnover or resistance coming from existing occupants who might choose for extra budget friendly options somewhere else.

6. Take care of Expenses Efficiently

To maximize your rental earnings, it is important to deal with expenses properly. Consistently inspect the home to pinpoint servicing needs and deal with them without delay. Implement energy-efficient measures such as putting up LED illumination or low-flow installations to decrease energy expense. Additionally, take into consideration working along with trusted sellers and company service providers who give competitive rates.

7. Pay for Down Your Home loan Faster

Once you begin acquiring rental revenue, assign a part of it in the direction of paying out down your home loan quicker. Through producing added remittances towards the primary harmony, you can easily lessen the interest paid for over the lifestyle of the financing. This approach are going to assist you build capital in your property a lot more promptly and eventually pay for off your home loan quicker.

8. Reinstate Rental Profit

Instead than utilizing all of the rental income to pay out down your mortgage loan, consider reinstating some of it back right into the building or purchasing additional rental residenti